Learning how to read a cheque is an essential financial skill that empowers you to manage your money effectively.

Technology has indeed advanced, and most Canadians are using wire transfers, electronic funds transfers, and direct deposits. However, knowing how to read a cheque can come in handy as some businesses and individuals prefer to send and receive money through cheques.

If you’ve ever received a cheque and felt like it was written in a foreign language, or if the concept of cheques seems unfamiliar to you, fear not.

In this comprehensive guide, we’ll walk you through the step-by-step process of reading a Canadian cheque, explaining the different parts of a cheque, including the numbers and different elements on the cheque.

Keep reading to learn everything you need to know about how to read a Canadian cheque.

What are The Parts of a Cheque?

To read a cheque accurately and ensure secure transactions without errors or discrepancies, it’s crucial to be familiar with its various parts.

Cheques vary across banks, but they all have one thing in common: they all contain the personal information of the account owner, bank details, and payment specifics like the amount and name of the recipient.

Discover the ins and outs of reading a cheque, equipping yourself with valuable knowledge for unexpected situations. Learn how to read a cheque and unlock its different sections with ease.

1. Personal Information

In the top left corner of a cheque, you’ll find the personal information section containing details about the authorized account user who issues the cheque.

This section typically includes the full name of the account holder as stated on their bank account, their home street address on the second line, and the city, province, and postal code on the third line.

If the cheque is personalized, this information is already pre-filled. When you receive a chequebook from your bank, the personal information section will already be pre-filled and printed for you.

However, if it’s a starter or temporary cheque, the user must manually write this information. It’s essential to verify that all the details are accurate and up-to-date.

2. Bank Name

This is the name of the banking institution that issued the cheque and also includes the address where the bank is physically located.

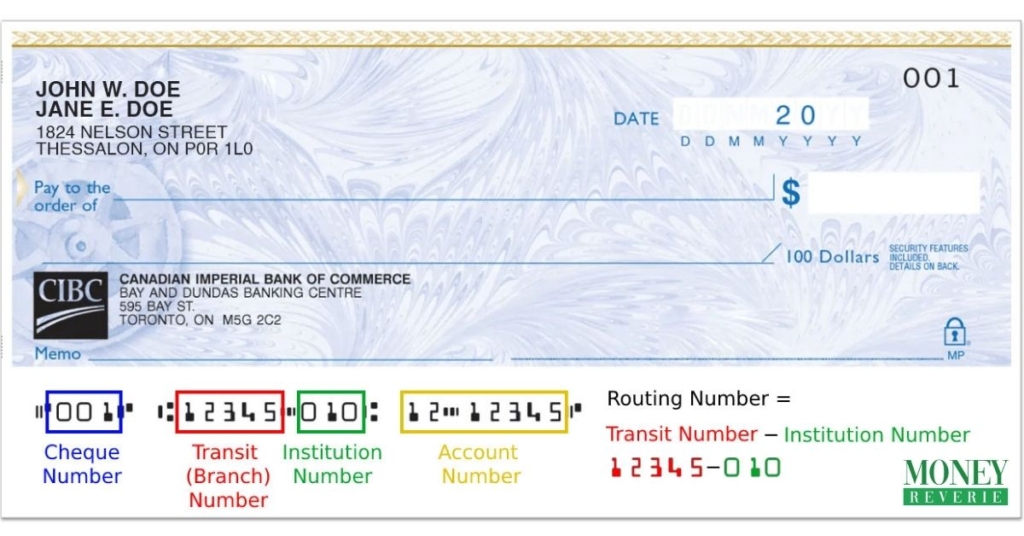

3. Cheque Number

This is the identity of the cheque. It is a necessity on every cheque. In chequebooks, cheques are usually numbered sequentially. It is usually a unique three-digit number that helps to identify the particular cheque for bookkeeping purposes and to identify discrepancies.

4. Transit Number

This is a 5-digit number that is also known as the Branch number. This number lets you know your home branch where you initially opened your bank account.

Your transit number will never change, and you will always retain the same number even if you relocate and start using your local branch. This number will only change if you close that account and open another one with another branch.

5. Institution Number

The institution number or the institution code is the bank identifier. This number lets you know the bank you are set up with, and the number is unique to each bank.

The institution numbers for the five biggest banks in Canada are:

- Bank of Montreal (BMO): 001

- Scotiabank: 002

- Royal Bank of Canada (RBC): 003

- TD Canada Trust: 004

- Canadian Imperial Bank of Commerce (CIBC): 010

6. Account Number

You are probably used to this. This is simply the bank account number assigned to you by the banking institution. This number is a unique identifier of your bank account, allowing you to make transactions. It is usually seven digits or more.

7. Routing Number

This number is what makes Canadian cheques different from American cheques. An American cheque will have this number, but a Canadian check will not.

In Canada, your routing number is a combination of the 5-digit transit number, dash, and the 3-digit institution code (read points two and 3 for further clarification).

8. The Recipient’s Line

The part of the cheque reads “pay to the order of” is where the name of the recipient or the beneficiary of the cheque is written.

This part is very important. You cannot cash the cheque if your name as an individual or (business) entity contains any error.

9. The Dollar Amount Box

This is the box that shows the dollar ($) sign. The amount to be paid to the cheque recipient is usually written here in numeric currency form.

It begins with the dollar sign, followed by the number of dollars and ends with a decimal and any cents.

10. The Dollar Amount Line (Amount Written In Words)

This part clearly states the amount to be cashed in words. It is very important and will reveal if the cheque has an error or has been tampered with.

Imagine if I wanted to issue a check for $20, but I added another 0 in error. Phew! Have I just issued a cheque for $200?

Absolutely…NOT! Since I have filled in the amount in words, there will be no room for any misunderstanding.

Exactly! This is the official worth of that cheque, and this amount is what you will be paid regardless of what is in the Dollar box.

11. The Memo Line

This line contains information on the objective of the cheque. For instance, if the cheque is for rent in the month of April, this part will document it as the reason the cheque was issued.

So, the memo line can say anything from “Happy Birthday”, and “Happy Anniversary” to January Rent”.

12. The Signature Line

This is the single most important security feature of the cheque. It shows who signed the cheque. If the cheque doesn’t have a signature, you may be unable to cash it.

Your signature can be anything, but you must ensure it is consistent. Try to make it unique and harder to forge.

13. The Back of the Cheque

If you receive a cheque but want to transfer it to a third party, you can endorse it by signing the back of the cheque.

You can make it more specific by writing “pay to the order of” followed by the person’s name, with your signature under it.

For some cheques, the back of the cheque will have an endorsement line.

Related: How to Write a Cheque in 6 Easy Steps

When Should You Use a Cheque?

While the usage of cheques has decreased with the rise of electronic payment methods, they still offer valuable benefits in certain situations. Here are some scenarios where using a cheque may be appropriate:

- Payment to Individuals: Cheques can be used to make payments to individuals, such as friends or family members, who may not have electronic payment capabilities or prefer not to provide their banking information for online transfers. This is particularly beneficial for paying for occasional services like dog walking.

- Large Transactions and Legal Situations: Some individuals or businesses may prefer using cheques as a more secure payment method for significant transactions involving large sums of money. Cheques provide a clear paper trail and serve as proof of payment, which can be advantageous in formal or legal situations, such as real estate transactions or legal settlements.

- Business Payments: Cheques can still be used for business-to-business transactions, especially when dealing with suppliers, contractors, or vendors who prefer or require payment by cheque. This can be particularly relevant for small businesses that may not have the infrastructure or preference for electronic payments.

- Accessibility and Elderly Population: Cheques can benefit elders without internet access or knowledge of online payments. They provide a familiar and accessible payment method for this demographic, ensuring they can participate in transactions without technological barriers.

- Post-dated Payments: Cheques can be used for post-dated payments, allowing the issuer to specify a future date when the recipient can deposit or cash the cheque. This can be useful for scheduled payments or when there is a need to control the timing of the transaction.

It’s important to consider the preferences and acceptance of the recipient when deciding whether to use a cheque.

However, it’s also worth acknowledging the convenience, speed, and security offered by electronic payment methods like bank transfers, online payment platforms, or mobile payment apps, which may be more suitable for everyday transactions.

Remember to keep unused cheques secure to prevent loss or theft, and always follow appropriate financial practices and guidelines to ensure the safety of your payments.

What Are The Merits and Demerits of Cheques?

Cheques have been a popular form of payment for many years, offering advantages and disadvantages. Let’s discuss the merits and demerits of cheques:

Merits of Cheques:

- Convenience: Cheques are widely accepted and provide a convenient method of payment. They can be used to make payments to individuals, businesses, and organizations without the need for carrying cash.

- Recordkeeping: Cheques provide a written record of transactions. Both the issuer and the recipient have physical proof of payment, which can be useful for accounting purposes or resolving disputes.

- Safety: Cheques can be a safer alternative to carrying large amounts of cash. They reduce the risk of theft or loss since the funds are transferred through the banking system rather than physically exchanging hands.

- Post-dated Payments: Cheques can be post-dated, meaning the issuer can specify a future date on which the recipient can deposit or cash the cheque. This allows for better control over when the funds are released.

Demerits of Cheques:

- Processing Time: Cheques can be cleared and credited to the recipient’s account. It often involves manual processing, which can result in delays, especially for interbank transactions. This can be a disadvantage when immediate funds availability is required.

- Fraud Risk: Cheques are susceptible to fraud. They can be forged, altered, or used for identity theft. Although security measures have improved, such as using security features and authentication mechanisms, the risk still exists.

- Insufficient Funds: There is a risk of issuing a cheque without sufficient funds in the account. This can lead to the cheque being bounced or returned unpaid, resulting in penalties for the issuer and inconvenience for the recipient.

- Lack of Universality: Cheques are not universally accepted in all situations or countries. Some businesses or individuals may not accept cheques due to the associated risks or the preference for more modern payment methods.

It’s important to note that with the advancement of technology, electronic payment methods such as online banking, mobile payments, and digital wallets have gained popularity. These methods often offer faster, more secure, and more convenient cheque alternatives, reducing the reliance on paper-based transactions.

Security Tips For Filling Out a Cheque

While cheques can be a convenient payment method, they’re also considered one of the riskiest financial instruments. Cheques can easily be lost, stolen, or even forged, leading to serious financial consequences.

Here are some of the best practices you can use to help protect yourself and prevent fraudulent use of your cheques:

- Avoid blank spaces on your cheques when filling in the Dollar amount box. Write at the far left edge of the box to avoid someone adding more figures to your amount. You can also draw a line after the last digit you write.

- Use a pen with permanent ink that cannot be easily erased.

- Don’t sign your cheque until you are ready, i.e. ensure you have the payee and dollar amount filled in before you sign.

- Ensure that you void cheques you don’t intend to use by writing “VOID” in bold letters across the cheque.

- Balance your chequebook by recording every cheque, noting the cheque numbers, the amount paid, the payee, and the date. You can opt for chequebooks with carbon copies for proper recording.

- Create a unique signature that would be hard to forge.

RELATED: What is a Void Cheque?

What is the MICR Encoding Line on a Cheque?

The MICR (Magnetic Image Character Recognition) line at the bottom of a cheque contains all the necessary information for bank machines to process cheques quickly.

The MICR line typically includes the cheque, transit, institution, and account numbers, providing the necessary data for automated processing and identification.

This specialized line of characters is printed with unique magnetic ink, allowing high-speed scanners to read the cheques accurately, regardless of signatures or stamps, even if it is partially damaged.

The MICR system was invented by IBM scientists in the 1950s to solve the problem of massive backlogs in paper processing.

Different regions adopt specific MICR fonts; for instance, E-13B is commonly used in Canada, the United States, Australia, and the UK, while CMC-7 is prevalent in South America and Europe. These fonts further enhance the reliability and accuracy of the MICR encoding system.

The MICR encoding line is vital in automating check handling and processing. This method ensures efficient check processing, reducing errors in banking operations.

Differences Between Canadian and U.S. Cheques

One of the most notable differences between Canadian and U.S. cheques is the word’s spelling. In Canada, the preferred and commonly accepted spelling is “cheque,” but in the United States, it is typically spelt as “check.” Although this variation may appear minor, it actually signifies the linguistic disparities between the two countries.

Apart from the spelling discrepancy, there are several other important dissimilarities between Canadian and U.S. cheques. Let’s explore these differences further:

- Date Format: One notable difference is the date format used on cheques. In Canada, the preferred format is day/month/year (e.g., 10/01/2024). In the United States, the standard format is month/day/year (e.g., 01/10/2024).

- Routing Numbers: When it comes to routing numbers, U.S. cheques have a nine-digit routing number that identifies the financial institution and branch. However, Canadian cheques use an eight-digit combination of transit or branch and institution numbers.

- Cheque Numbers: Canadian cheques always place the cheque number on the far left side of the MICR encoding line at the bottom of the cheque. In contrast, U.S. cheques typically place the number on the far right side. Also, Canadian cheque numbers have a maximum length of three digits, while U.S. cheque numbers are usually four digits long.

- Canadian cheques are denominated in Canadian dollars (CAD), while U.S. cheques are denominated in U.S. dollars (USD). This distinction is important because it affects the exchange rate and how the cheque amount is interpreted.

By understanding these key differences, you’ll be better equipped to handle Canadian and U.S. cheques and navigate the unique aspects of each system.

Remember, whether you’re dealing with a “cheque” or a “check,” knowing the variations can make all the difference!

Final Thoughts on How To Read a Cheque

Understanding how to read a cheque is a valuable financial skill that empowers you to manage your money effectively. While electronic payment methods are increasingly popular, cheques still have their place in various transactions.

By familiarizing yourself with the different elements of a Canadian cheque, you can confidently navigate the banking world. It’s also important to recognize the distinctions between Canadian and U.S. cheques to handle different cheque systems seamlessly.

Cheques offer advantages such as convenience, recordkeeping capabilities, and a sense of security. However, it’s essential to be aware of potential drawbacks, including processing time, fraud risks, insufficient funds, and limited universality.

To ensure the safety of your cheques, following best practices is crucial. You can minimise the risk of fraudulent activities by employing preventive measures, such as using secure mail for cheque deposits and regularly monitoring your account.

Whether you’re receiving a cheque as payment or need to write one yourself, having this knowledge will help facilitate smooth transactions and safeguard your financial interests.

So, the next time you come across a cheque, you’ll be ready to tackle it like a pro.

FAQs On How To Read a Cheque

Can Cheque Books Expire?

No. Your chequebooks themselves do not expire. However, the cheques within them do. Once you’ve written a cheque, it usually has six months before it turns “stale.” This means the payee has six months to present it to the bank before it expires.

Once a cheque becomes stale, it can still be presented to the bank and honoured or returned unpaid at their discretion. If you have received a cheque nearing its sixth month of age, we recommend contacting your payee to see if they will either cancel it or write you a new one.

What Is the Cost of a Chequebook?

If you plan on writing a lot of cheques, the cost of a chequebook can add up. The price will vary depending on your bank and how many cheques are in each book. You can expect to pay $25 for a book for a favourable price.

If it’s a not-so-favourable price, you may pay as much as $70 for the same number of cheques. These chequebooks usually contain anywhere from 10 to 25 cheques. If you need more than one book at a time, your bank usually provides them.

Contact your bank to determine how much chequebooks cost and the payment terms.

Why Are Cheques Still Relevant in This Age of Electronic Transfers?

You’ve probably heard of e-transfers. They’re popular, they’re easy, and they’re usually free. So, you are probably asking yourself, “Why do I have to know how to read a cheque?” The downside of e-transfers is that they aren’t always the most convenient option. Writing a cheque is more advantageous in some situations than sending an e-transfer. How do we know?

Limits are placed on how much money you can send via an e-transfer. These limits can vary depending on who you bank with and your account type.

For example, one bank may allow you to send up to $5,000, while another might only allow $3,000. Cheques don’t have monetary limits. Nothing else matters if the amount is written on the cheque and it’s correct. You can make deposits and withdrawals when you want with cheques.