Looking to dive into the exciting world of trading but don’t know where to start or which trading platform to use for your daily trading? Well, get ready to be blown away because today I will introduce you to an absolute game-changer: Interactive Brokers Canada. Trust me; this is a topic you don’t want to miss out on!

Interactive Brokers Canada is not just your regular brokerage platform; it is a cutting-edge tool for self-directed investors to access electronically traded securities directly. As one of the leading brokerage platforms in Canada, they offer a wide range of options for self-directed investors like you and me. It’s not just limited to shares! We’re talking about options trading, futures, forex, bonds, and funds on a whopping 135 markets – all from one single integrated account.

But what exactly do they do, and what do they offer? In this article, I will walk you through everything you need to know about Interactive Brokers Canada. We’ll cover everything from their cutting-edge platform to their vast array of trading options. Whether you’re a seasoned investor or just dipping your toes into the trading world, this article has got you covered.

Get ready for an in-depth look at how Interactive Brokers Canada can revolutionize your trading experience. We’ll talk about their seamless access to electronically traded securities, options trading capabilities, and more. By the end of this article, you’ll be itching to open your own account with Interactive Brokers Canada and start making some savvy investments.

So, if you’re ready to dive into the exciting world of trading and take control of your financial future, buckle up and get ready for an exhilarating journey. Join me as we unravel the wonders of Interactive Brokers Canada in this comprehensive review. Trust me; it’s time to take your trading game to the next level!

Interactive Brokers Canada Review Summary

Interactive Brokers (IBKR) is a renowned brokerage firm that originated in the United States back in 1978 and expanded its operations to Canada in 2000. With 12 trading platforms at its disposal, IBKR caters to both institutions and individuals, offering access to 150 markets across 33 countries. Apart from Canada, IBKR operates in the US, Hong Kong, Japan, India, UK, Switzerland, Estonia, Russia, China, and Liechtenstein. IBKR adheres to regulations set by various authorities and is a member of the Industry Regulatory Organization of Canada (IIROC) and the Canadian Investors Protection Fund (CIPF).

What Is Interactive Brokers Canada and How Does it Work?

Interactive Brokers (IBKR) is a brokerage firm founded in the United States in 1978 and expanded into Canada in 2000.

IBKR serves institutions and individuals through 12 trading platforms and has a presence in 150 markets in 33 countries, powered by its proprietary SmartRouting technology, which finds and delivers the best prices.

In addition to Canada, IBKR operates in the US, Hong Kong, Japan, India, the UK, Switzerland, Estonia, Russia, China, and Liechtenstein.

IBKR is regulated by several authorities and is also a member of both the Industry Regulatory Organization of Canada (IIROC) and the Canadian Investors Protection Fund (CIPF).

Interactive Brokers Canada Account Types

First, let’s start with their most popular, the Tax-Free Savings Account (TFSA). If you’re a Canadian resident over the age of 18, you can put money in this account tax-free.

Another popular option is the Retirement Savings Plan (RRSP), which is great for retirement savings. You can claim all deposits into your RRSP as deductions on your tax return.

The other accounts supported are:

- Individual Accounts,

- Joint Accounts,

- Trusts,

- Registered Retirement Accounts (RRSP),

- Friends and Family account for groups of up to 15 people,

- Family Office accounts for individuals who are family office managers,

- Small Business accounts for small corporations and businesses,

- Advisor accounts for individuals who manage both client administration and money,

- Money Manager accounts for individuals hired on behalf of an advisor that is different.

Interactive Brokers Canada Investment Products

With Interactive Brokers Canada, you have a vast array of securities to choose from. Let’s take a look at the options available:

- Stocks: Trade stocks in 150 international markets effortlessly.

- Futures: Take advantage of trading futures contracts in 35 financial markets.

- ETFs: Enjoy trading equity and bond ETFs on 28 exchanges.

- Options: Engage in options trading for added flexibility.

- Bonds: Access over 1 million corporate, municipal, and government fixed-income securities.

- Hedge Funds: Accredited investors can participate in hedge fund investments through Interactive Brokers.

- Mutual Funds: Explore a wide selection of over 40,000 mutual funds.

- Spot Currencies: Access 26 trading currencies, including USD, CAD, EUR, GBP, AUD, CHF, and HKD.

Interactive Brokers Canada Fees

When it comes to the pricing of Interactive Brokers Canada, it’s important to note that it is not as straightforward as some of its Canadian counterparts. The commission schedule and pricing structure can vary depending on the type of security you are trading.

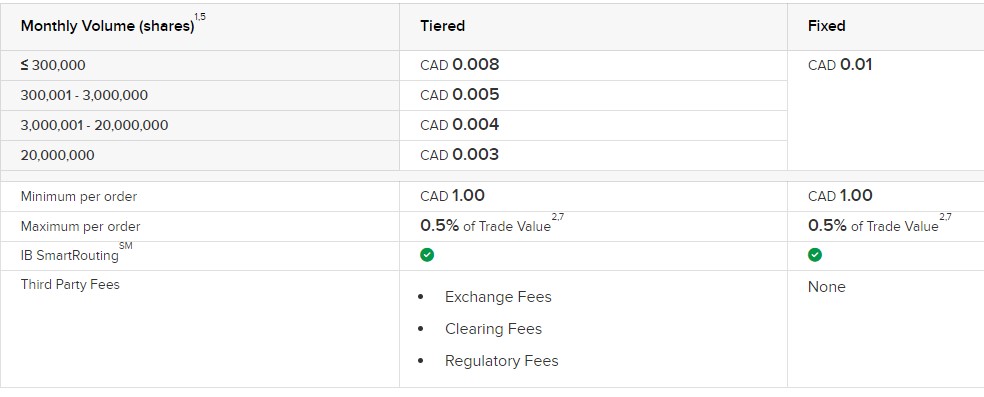

You have two options for stocks, ETFs, and warrants: a tiered rate or a fixed rate. The fixed rate is $0.01 CAD per share for Canadian stocks and $0.005 USD per share for U.S.-denominated stocks, with a minimum commission of $1. This means that if you purchase 500 shares of a Canadian-listed stock, you would pay $5 in trading commissions.

On the other hand, active traders may benefit from the tiered pricing model, which offers lower fees for larger trades. This tiered fee structure applies to Canadian stocks, ETFs, and warrants. The commission decreases based on factors such as volume, exchange, regulatory, and clearing fees.

Interactive Brokers Canada aims to provide a clear and understandable pricing system. You can choose between tiered or fixed rates based on your trading preferences. The tiered pricing model allows for reduced commissions based on various factors, while the fixed-rate option involves a fixed low commission per share or a set percentage of the total trade amount.

Below is the tiered fee model for Canadian stocks, ETFs, and warrants:

Source: www.interactivebrokers.ca

Interactive Brokers Account Minimum Fee

Interactive Brokers Canada has eliminated its inactivity fee. So, you no longer have to worry about a monthly charge of $20 USD if your account balance falls below $100,000 USD.

However, it’s important to know other fees that may apply. Here are a few to watch out for:

- RSP withdrawal or de-registration: A fee of $50 will be charged for these transactions.

- Cash withdrawal (1 free per month): If you exceed the monthly limit, there will be a fee of $12 CAD for wire transfers and $2 CAD for ACH/EFT/SEPA transfers.

- Telephone orders for closing positions: If you choose to close your positions over the phone, a fee of $40 CAD per order will be incurred.

It’s always a good idea to stay informed about the fees associated with your trading activities. By keeping an eye on these charges, you can make sure to optimize your trading experience with Interactive Brokers.

Interactive Brokers Canada Trading Platforms

Interactive Brokers offers a range of powerful trading platforms designed to cater to traders of all experience levels. Let’s explore these platforms:

- Client Portal (Web Application): Accessible through any web browser, the web application allows you to trade seamlessly across all your devices.

- IBKR Mobile App: Available for iOS and Android devices, the mobile app provides a user-friendly and convenient way to trade.

- Trader Workstation: Designed for active traders, this platform offers comprehensive trading capabilities and allows you to track multiple products simultaneously.

- IBKR APIs: For those who prefer to build custom trading applications, Interactive Brokers provides APIs that allow you to integrate their services into your own software.

All of these platforms grant access to live or delayed market data and scanners. You can stay up-to-date with research and news and utilize technical analytical tools to inform your trading decisions.

When it comes to market data, delayed information is available free of charge. You can subscribe for a fee if you require real-time streaming market data. Level 1 and level 2 market data are available for the TSX Venture Market, Toronto Market, and Montreal Exchange.

Interactive Brokers ensures that traders have access to the necessary tools and information to make informed trading decisions, whether they’re on the web, on mobile devices, or utilizing specialized trading software.

Interactive Brokers Customer Service

While Interactive Brokers (IBKR) has faced criticism regarding its customer service in the past, the company is actively working to improve its reputation in this area. One notable addition to enhancing customer support is the IBot service, which utilizes an artificial intelligence engine to provide answers to questions in plain English.

IBot is conveniently accessible across the website and trading platforms, enabling customers to find answers without enduring long wait times. Moreover, there are several avenues for customer support:

- Toll-free telephone support is available 24 hours a day, six days a week, ensuring assistance is just a call away.

- The callback service allows customers to request a call back if they need to hang up without losing their place in line.

- Online chat with a human agent is available directly from within the trading platform or website, providing real-time support.

- The secure message centre, also accessible within the trading platform or website, allows for communication and assistance.

With the help of AI-powered IBot, customers are directed to online FAQs and resources, further aiding in finding the information they need.

Interactive Brokers recognizes the importance of efficient and effective customer service, and through these initiatives, they are committed to addressing and improving their customer support experience.

Is Interactive Brokers Canada Safe?

Interactive Brokers Canada offers you peace of mind by providing comprehensive investment protection. As a member of the Canadian Investor Protection Fund (CIPF), your investment account is insured for up to $1 million in the event of the firm’s bankruptcy. This coverage includes your account balance, the market value of securities held in your account, and any cash owed to you by the broker.

To further ensure the safety of your investments, Interactive Brokers Canada is also a member of the Investment Industry Regulatory Organization of Canada (IIROC). This organization sets and enforces rules that promote transparency and fairness in the industry. By adhering to these rules, Interactive Brokers Canada protects investors and maintains a trustworthy environment.

It’s worth noting that Interactive Brokers Canada operates under the parent company, IBKR, which holds broker/dealer licenses in multiple countries. With over four decades of experience, IBKR has established a strong reputation and has been recognized with various “best broker” awards across different categories.

With Interactive Brokers Canada, you can have confidence in the safety and security of your investments. The CIPF coverage and membership with IIROC provide you with the necessary safeguards, while the track record and accolades of IBKR underscore their commitment to excellence in the industry.

Here are some important factors about IBKR that meets or exceeds industry security standards:

- Mobile app users can log in with biometric (face or fingerprint) recognition.

- Multiple forms of two-factor authentication.

- Client securities account at Interactive Brokers LLC are protected by the Securities Investor Protection Corporation (SIPC) for up to $500,000, with a cash sub-limit of $250,000. Excess SIPC coverage provides up to an additional $30 million (with a cash sub-limit of $900,000), subject to an aggregate limit of $150 million.

- Interactive Brokers’ Bank Deposit sweep program enables clients to supplement their existing $250,000 SIPC coverage with $2,500,000 of FDIC insurance on eligible cash balances.

- Through 2020, no significant data breaches at any IBKR location were reported by the Identity Theft Research Center.

Interactive Brokers Education

Interactive Brokers of Canada provides a broad range of investor education programs for customers and the public.

Traders Academy (revamped in 2020) is an online, on-demand resource with a structured, rigorous curriculum intended for financial professionals, investors, educators, and students who want to learn about asset classes, markets, currencies, tools, and functionality available on IBKR’s trading platforms.

Quizzes and tests benchmark student progress against learning objectives and allow students to learn independently.

Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin.

Some courses cover the various IBKR technology platforms and tools. The website includes a trading glossary and FAQ.

IBKR and industry experts offer daily webinars. These events cover various topics, including how-tos for platforms and tools, options education, trading international products, and more.

There are hundreds of recordings available on-demand in multiple languages, including English, Spanish, Chinese, Italian, and French.

Interactive Brokers Canada Pros and Cons

How Does Interactive Brokers Canada Compare To Other Trading Platforms in Canada?

Other trading platforms in Canada offer similar features to Interactive Brokers Canada. Here are the top recommendations:

1. Qtrade

With a history dating back to 2000, Qtrade Direct Investing is among Canada's oldest trading platforms, catering to beginner and advanced investors with equal aplomb. Its intuitive design and well-thought-out interface make it an excellent choice for novices, while its advanced research tools cater to the needs of more experienced investors.

- Get up to $2000 cashback

- Up to $50 sign-up bonus

- Offer ends March 31, 2024

Qtrade is undoubtedly one of the best Canadian online brokerage platforms that give its clients access to bonds, mutual funds, and the stock market. The company was founded in 1999.

Qtrade is renowned for its low fees and impressive customer service, and you can use Qtrade on the web or on their app (which is available on Android or iOS devices). You can check out our Qtrade Review for more information or learn how Qtrade and Questrade compare.

2. Questrade

Questrade is an online discount brokerage established in 1999 with a $25 billion asset under management. Its popularity in Canada lies in its low commission, low trading fees, and multiple ranges of accounts. As a result, both beginners, intermediate and seasoned investors in Canada find Questrade attractive for DIY and active management investing.

Key Features

- Free tax-loss harvesting

- Low management fees

- Several investment options

- Automatic portfolio rebalancing

- Active management

- Ease of use

This is a top independent online brokerage service in Canada with $25 billion in assets under management. It offers free ETF purchases and low fees when you buy and sell stocks ($4.95 to $9.95 per trade).

New customers get $50 in free trades when they open an account on Questrade and fund it with at least $1,000. For more information, check out our Questrade Review.

3. Wealthsimple Trade

Wealthsimple Trade is a great trading platform that offers commission-free buying and selling of thousands of stocks. Its user-friendly interface and mobile-optimized investing dashboard make it easy to navigate and accept various payment methods, such as bank transfers and debit cards. In addition to traditional online stock trades, Wealthsimple Trade allows you to engage in other investment activities. It supports both taxable and registered (non-taxable) accounts such as RRSP and TFSA, and there is no minimum balance requirement when opening an account, making it accessible for investors with little money.

The Wealthsimple Trade app is one of the most popular ways for self-directed investors to buy and sell thousands of stocks and ETFs on their mobile devices.

It’s Canada’s only no-commission broker for stocks and ETF trades. The app is free to download and use and has no account minimums or setup fees.

For more, check out our extensive Wealthsimple Trade Review. You can also check out our detailed Questrade vs Wealthsimple comparison analysis.

Final Thoughts on Interactive Brokers Canada Review

After diving deep into the world of Interactive Brokers Canada, I can confidently say that this brokerage platform is a game-changer for investors like you and me. From their cutting-edge trading platforms to the vast selection of securities available, Interactive Brokers Canada leaves no stone unturned.

If you’re ready to take your trading experience to the next level, I highly recommend trying Interactive Brokers Canada. Don’t miss out on the opportunity to access 150 international markets, trade stocks, ETFs, options, futures, and so much more, all from one integrated account.

So, what are you waiting for? Take the leap and embark on an exciting journey with Interactive Brokers Canada. Join Interactive Brokers Canada now, and let’s make the most of our investment journey together!

FAQs on Interactive Brokers Canada Review

How can I send feedback to Interactive Brokers?

- Log in to Client Portal.

- Click the Help menu (question mark icon in the top right corner) followed by Provide feedback.

When was Interactive Brokers founded?

Interactive Brokers Group, Inc. was founded by its Chairman, Thomas Peterffy. Over the last 43 years, it has built itself up to become one of North America’s biggest securities firms, with over $9.4 billion in equity capital.