Are you ready to leap into homeownership but overwhelmed by all the financial jargon and numbers? Trust me; I’ve been there too. The thought of calculating mortgage costs used to send shivers down my spine, but that was before I discovered the ultimate game-changer – the mortgage calculator!

Gone are the days of drowning in confusing spreadsheets and stressing over complex equations. With a mortgage calculator by your side, you’ll be able to easily sail through the process of estimating your mortgage costs. It’s like having a wise financial advisor in your pocket, ready to assist you whenever needed.

In this exciting blog post, I’ll show you how incredible mortgage calculators are and how they can make a difference in your home-buying journey. We’ll walk hand in hand through the world of mortgage payment calculators, unravelling their mysteries and empowering you with the knowledge to choose the perfect mortgage loan for your unique situation.

What is a Mortgage, and How Does it Work?

A mortgage is a loan used to buy a house when you don’t have all the money upfront. Many Canadian homeowners use mortgages to purchase their homes. You’ll need a mortgage if you can’t afford to pay for a property in full.

Even if you have enough money, getting a mortgage might still be a good idea in certain cases, especially if you want to invest in a house. You’ll typically need a steady income and a decent credit score and history to qualify for a mortgage.

A mortgage payment is the monthly amount you pay to clear your mortgage loan. Your mortgage loan consists of the principal (the total amount borrowed) and the interest (the amount charged by the lender).

Each month you make your mortgage payment, a portion goes towards reducing the principal, while the rest covers the mortgage interest. The interest rates can vary between different mortgage loans, so you may need a special calculator to know the exact cost of your mortgage loan.

What is a Mortgage Calculator, and How Does it Work?

A mortgage calculator is a specialised tool that helps you determine your mortgage loan amount and monthly payments. It also provides information on your payment schedule and negotiation options, making it easier to find the right mortgage. Understanding the different types of mortgage calculators is essential for making cost-effective decisions.

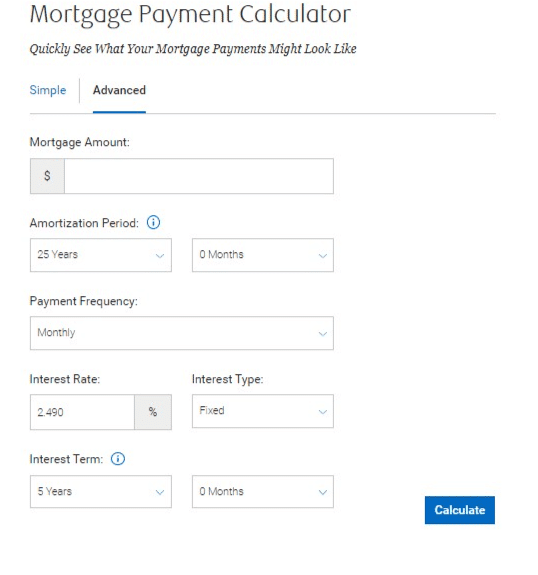

A mortgage payment calculator operates simply. You only need to provide basic information to obtain the result quickly. The required information includes:

- Total Mortgage Amount: The full price of the house you’re buying, excluding the down payment.

- Amortisation Period: The total duration or term of your mortgage loan, typically 5 to 25 years or more.

- Mortgage Rate: The interest rate on your mortgage, determined by whether you choose a fixed or variable rate.

- Payment Frequency: Your mortgage loan payment schedule, which could be weekly, bi-weekly, monthly, etc.

Once you input the above information, the mortgage payment calculator will provide an accurate estimate.

Types of Mortgage Calculators

- Mortgage Affordability Calculator: This calculator helps you find a mortgage that suits your needs and budget. Assessing your family income and expenses, it assists in finding an appropriate mortgage for you. It is best used before applying for a mortgage loan.

- Mortgage Payment Calculator: This calculator determines your monthly mortgage payment based on a down payment, mortgage term, and interest rate. It also helps you create an efficient payment schedule to save costs. You can use it both before and after getting mortgage loan approval.

- Mortgage Prepayment Charge Calculator: This calculator aids in identifying ways to renegotiate high mortgage rates for lower ones. It also calculates the necessary payments to clear your mortgage ahead of schedule and the associated interest charges. Checking your mortgage agreement for potential prepayment charges is crucial when using this calculator.

Benefits of Using a Mortgage Calculator

Using a calculator for a mortgage offers numerous advantages, some of which are highlighted below:

1. Accurate Estimate

A mortgage calculator accurately estimates the mortgage amount you require and the payment structure. This eliminates guesswork and enables you to focus on essential aspects.

2. Time Savings

Utilizing a mortgage calculator can swiftly determine the ideal mortgage loan, payment amount, and schedule, thus saving valuable time. Just input basic information, and you’ll have an accurate estimate within seconds.

3. Easy Comparison of Options

Comparing various mortgage options is crucial to making an informed decision. A mortgage calculator simplifies this process, allowing you to choose the perfect mortgage that aligns with your needs and budget, covering aspects like mortgage terms and rates.

4. Cost Savings

Using a mortgage calculator is a cost-effective approach to acquiring and repaying your mortgage. By leveraging this tool, you can potentially save thousands of dollars on mortgage interest rates and secure a suitable mortgage loan.

The Best Mortgage Payment Calculators in Canada

When it comes to mortgage payment calculators in Canada, there are several options available. However, not all calculators are equal in functionality and accuracy. Using the most reliable and effective mortgage payment calculators is essential to ensure the best results.

Based on personal experience and positive feedback from others, here are the top mortgage payment calculators in Canada:

1. Rate Hub Mortgage Payment Calculator

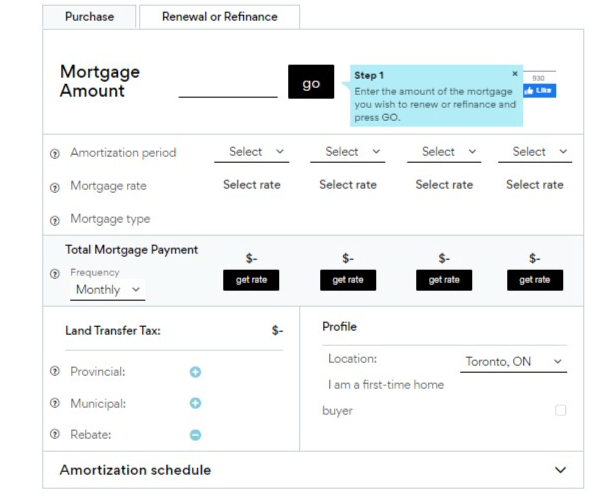

Rate Hub is a leading FinTech company based in Canada. With the Rate Hub calculator, you can easily calculate your mortgage payment by entering essential details such as your mortgage amount, amortisation period, mortgage rate, and payment schedule. This tool simplifies the process of understanding and estimating your mortgage payments.

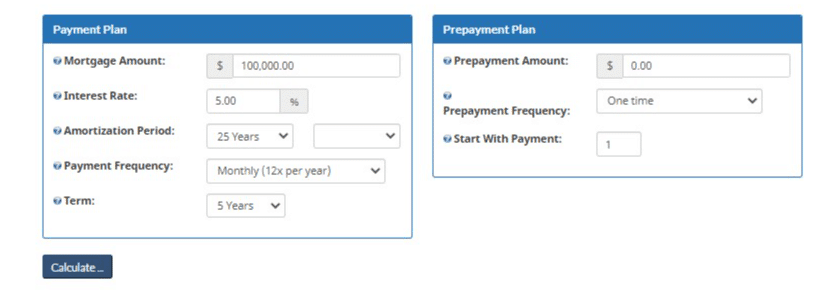

2. Canada Revenue Agency Mortgage Payment Calculator

Introducing the CRA (Canada Revenue Agency) calculator, designed to assist you in effortlessly calculating your mortgage payment. Just like the Rate Hub calculator, this tool enables you to determine your mortgage payment with ease and precision.

Additionally, it provides valuable insights on optimizing your mortgage payments for maximum cost-effectiveness. So, use this user-friendly calculator to make informed decisions about your mortgage repayment strategy.

3. CIBC Mortgage Payment Calculator

The CIBC calculator is a versatile tool that can help you calculate your mortgage payment accurately. It allows you to determine the timing of your payments as well. In addition to that, CIBC provides other useful calculators, such as a mortgage affordability calculator, mortgage selector, mortgage prepayment charge calculator, and home equity calculator.

These calculators can assist you in making informed decisions about your mortgage and home financing options.

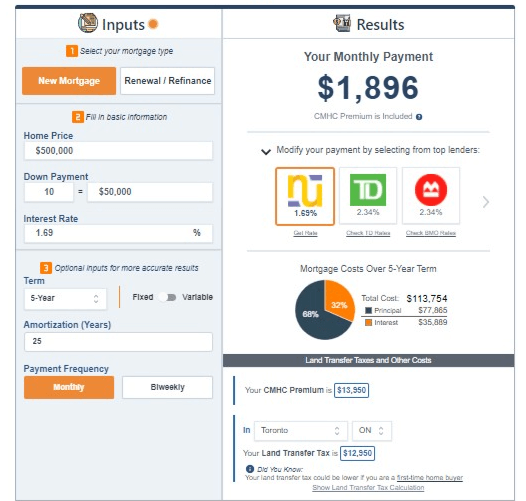

4. WOWA Mortgage Payment Calculator

Whether you’re seeking a new mortgage or aiming to renew/refinance your existing one, the WOWA calculator is here to assist you. It’s designed to cater to all Canadian provinces, allowing you to make well-informed decisions about your mortgage payments.

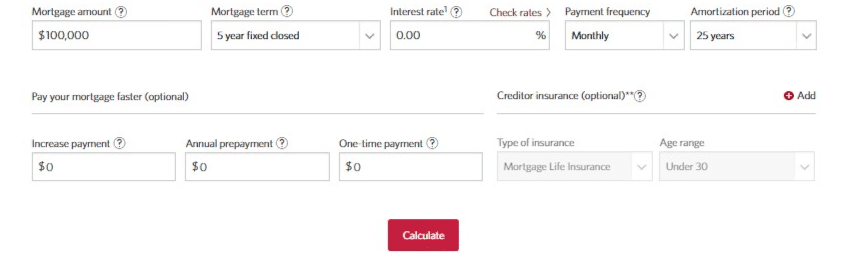

5. RBC Mortgage Payment Calculator

The Royal Bank of Canada offers an excellent mortgage payment calculator, which stands out as one of the best options available. This calculator functions similarly to other mortgage calculators by using the basic information you provide to generate a precise estimate of your mortgage payment. But if you’re looking for other calculators for mortgages, consider the CIBC range of calculators.

Practical Tips for Lowering Your Mortgage Payment

Getting approved for a mortgage is one thing, but maintaining consistency in your payments over time is another challenge. Life’s surprises can sometimes make meeting your required mortgage payments difficult. If you want to reduce your high mortgage payment and manage your finances better, consider following these five practical tips:

1. Make a Bigger Down Payment

When obtaining mortgage approval, a minimum down payment is usually required. However, a larger down payment can lead to a lower payment rate. It’s wise to consider putting down more money upfront, as it can also impact the length of your mortgage period. For instance, a down payment below 20% may lead to a longer 25-year amortisation period.

2. Consider Additional Sources of Income

Lowering your mortgage payment can be achieved through prepayment—paying your mortgage ahead of schedule. You can create additional income streams through side hustles or other means, enabling you to make prepayments and reduce your amortisation period. Be aware that some mortgage agreements may include charges for making prepayments.

3. Know When to Extend the Amortization Period

Extending the mortgage term can help avoid penalties for late payments or defaults. The right time to extend your mortgage amortisation period depends on your current financial situation. If you’re facing financial difficulties, extending the period might be necessary. Alternatively, it could be a viable option if you need investment funds.

4. Consider Negotiating a Lower Mortgage Rate

Whether you have a fixed-rate or variable-rate mortgage, exploring opportunities to negotiate a lower mortgage rate is essential. Engaging a mortgage broker can be helpful in this regard. A lower mortgage rate directly translates to a reduced mortgage payment, particularly if you have a mortgage with high interest.

5. Avoid Taking on Additional Debt

To effectively lower your mortgage payment, refrain from accumulating more debts and prioritise paying off your mortgage. Remember that a mortgage is also a type of loan, so taking on additional loans can create financial challenges and hinder your ability to pay off your mortgage promptly. Avoid adding to your financial burden by refraining from secured and unsecured loans.

RECOMMENDED READINGS:

- Neo Mortgage Review (2024): Fast Digital Mortgage

- Mortgage Insurance Vs Life Insurance: Which Is Better (2024)

- Best Credit Union Mortgage Rates in Canada (2024)

- Is Mortgage Life Insurance Protection Worth it in 2024?

- Is there Tangerine Mortgage Preapproval? Everything You Should Know

- Tangerine Mortgage Rates for Canadians (2024): Pros, Cons, Rates, and Bonus

Final Thoughts on Mortgage Calculator

This mortgage calculator has been a valuable tool in helping estimate potential mortgage payments. This user-friendly and efficient tool lets you better understand your financial commitments and make well-informed decisions on your home-buying journey.

Take your mortgage planning to the next level and explore various mortgage options, interest rates, and down payment scenarios with our advanced mortgage calculator! With just a few clicks, you can gain deeper insights into your financial possibilities and secure the best mortgage deal tailored to your needs.

FAQs on Mortgage Calculator

Is the Mortgage Calculator Free?

Yes, most mortgage calculators in Canada are free, including the ones listed above.

How is a Mortgage Calculated in Canada?

A mortgage in Canada is calculated using the total mortgage amount, interest rate, amortisation period and payment schedule.

Can You Negotiate Mortgage Rates in Canada?

Yes, you can negotiate lower mortgage rates in Canada using a mortgage broker. However, your success depends on your credit score and credit history.

Is it Better to Get a Mortgage from a Bank or Broker?

It depends on your credit score and source of income. A bank requires a steady stream of income and a decent credit score. However, a broker may help you find a lender to approve your mortgage if you have issues.

Which Payment Schedule is Right for Me?

It depends on your cash flow. If you have enough cash flow, choosing a weekly or biweekly payment schedule is better to cut down your mortgage cost and amortisation period. But if you have limited cash flow, stick to a monthly payment schedule.

Thank you for sharing Adeola.

Can I make use of any of the listed mortgage calculators offline?