Steinbach Credit Union is a financial institution that has served the communities of Steinbach and surrounding areas for over 80 years. The company has grown to become one of Canada’s largest credit unions and the largest in Manitoba.

Steinbach Credit Union offers various personal banking services, including chequing and savings accounts, mortgages, loans, lines of credit, and credit cards. It is known for its commitment to providing excellent customer service and competitive rates.

In this Steinbach Credit Union review, we will provide a comprehensive overview of the credit union. We will examine its pros and cons, account types, investments, credit cards, and other offerings. We’ll closely look at what sets Steinbach Credit Union apart from other credit unions in Canada.

What is Steinbach Credit Union?

Steinbach Credit Union is a member-owned financial institution serving the Steinbach and surrounding communities since 1941. It is one of the largest credit unions in Manitoba, Canada, with over 100,000 members and assets of over $7 billion.

The credit union is committed to providing various financial products and services, including personal and business banking, investment, and insurance services.

SCU operates out of three large branches: one in Steinbach and two in Winnipeg. With its community-oriented foundation and long history of serving Manitobans, Steinbach Credit Union is a considerable choice for your money management needs.

You can access their services by downloading their mobile app from Google Play or App Store. Their website is also an option.

Benefits and Downsides of Steinbach Credit Union

Steinbach Credit Union offers some amazing features that make it standout from other credit unions in Canada. Check out the benefits and downsides of this credit unions:

Pros

- The rates on savings and GICs are quite attractive

- Day-to-day service plans tailored to your needs

- ATMs are available in Canada

- For business and agricultural members, there are services just for them

Cons

- There are just three physical locations

Steinbach Credit Union Accounts

Check out the list of accounts offered by Steinbach Credit Union to help you decide which is best for your needs. Steinbach Credit Union offers both chequing accounts and savings accounts.

Chequing Accounts for Steinbach Credit Union

SCU offers various chequing accounts, including accounts for students and seniors and a U.S. chequing account that makes managing finances across the border easy.

The most important distinction between these accounts is that they all have different monthly fees, minimum balance requirements, perks such as overdraft protection (some accounts provide it, some don’t) and interest rates on balances. Here they are:

1. Standard Pack Chequing

This Standard Pack Chequing account has no monthly fee, but you get one free debit monthly per $500 minimum balance.

After that, most debit transactions cost between $0.55 and $0.65. ATM withdrawals that are not credit union costs $1.50. Put these details in mind when making your decisions.

2. Value Pack Chequing

With this account, you don’t have to worry about high maintenance. It’s also great for those who carry out roughly ten transactions weekly. With a Value Pack account, you’ll get 35 free monthly debit transactions and five free Interac e-Transfers monthly. However, there’s a monthly fee of $8.95.

3. Classic Pack Chequing

This account lets you make unlimited debit transactions for only $15.50 monthly. Plus, it gets ten free Interac e-Transfers and a $5 discount on annual safety deposit box rentals.

I would recommend this account if you don’t want to worry about keeping track of the number of unlimited debit transactions you make. It’s free of that hassle.

4. E-Pack Chequing

With this account, your monthly fee is only $5.00. Still, you get 15 free digital debit transactions (credit union ATM withdrawals, telephone bill payments, and pre-authorized debits) and five free Interac e-Transfers. Plus, you get another 10% off if you open two accounts simultaneously.

5. U.S. Chequing

Are you planning a trip to the United States? Or do you have family in the U.S. that you send money to regularly? If so, a U.S. chequing account is exactly what you need to keep your money safe and accessible.

With a $0.05% monthly fee, a U.S. chequing account is perfect for storing your U.S. cash or any money you plan to send to someone in the States. And there’s more good news: you get one free cheque or debit for every $1,000 minimum account balance.

6. Spendwise Account

The Spendwise account is for members 18 years old and younger and has great features. It helps you get started on the right foot with all the tools you need to manage your money, with no service fees or monthly charges.

Spendwise has unlimited transactions, so you can make as many payments, withdrawals, and transfers as possible. Plus, it comes with free Interac e-Transfers, so you can send money to friends and family at no extra cost.

7. StudentFLEX Daily Account and Infinite Daily Account

The StudentFLEX Daily Account is an ideal option if you’re in post-secondary education and use a moderate number of monthly transactions.

This account offers up to 35 free transactions per month and unlimited e-Transfers, so you can focus on your studies instead of worrying about overdraft fees.

For an Infinite Daily Account, you get unlimited transactions for just $10/month.

8. On Track Pack Chequing

With the On Track Pack chequing account, you can still enjoy the services of Steinbach Credit Union if you are not a full-time student between the ages of 19 to 24.

For just $5/month, you’ll get 35 free monthly transactions and unlimited e-Transfers, along with access to their state-of-the-art mobile app to manage your money on your schedule online.

9. Golden Chequing

This unlimited, free account gives you one free order of personal cheques every year and a discount on safety deposit box rentals, too. It is for those 60 and over.

Savings Accounts for Steinbach Credit Union

1. High-Interest Savings Account

High-interest Savings Account is an appealing option if you want to start saving now. It lets you maximise your savings at competitive variable high-interest rates starting at 3.50% for $100,000.

The only tricky part is that your interest is calculated on the minimum monthly balance, not the current balance. But that’s pretty standard for most banks, so it shouldn’t be a major issue.

2. Plan 24 Savings

Plan 24 Savings account is for people who want to keep their money secure and grow it with a great annual interest rate.

No minimum monthly balance, interest is calculated daily and paid monthly, and you have one free withdrawal and $1 after.

While the interest rate is lower than those offered by many other banks, at 2.50%, the calculation of interest daily and monthly payment helps you to earn more than most banks offer. And there’s no monthly maintenance fee, so you can just focus on growing your savings.

3. Monthly Savings

This account pays interest monthly. At a rate of 2.70%, it is considerably high among the interest rates you will find online. If short-term funds are your thing, this is the place for you.

4. SaveWise Account

If you have a balance of up to $2000 and are 14 or under, the interest rates will largely be in your favour. At 5.50%, the interest rate is quite juicy and generous.

Steinbach Credit Union Investments

SCU offers popular investment accounts and assets. Here are some of their best investment accounts.

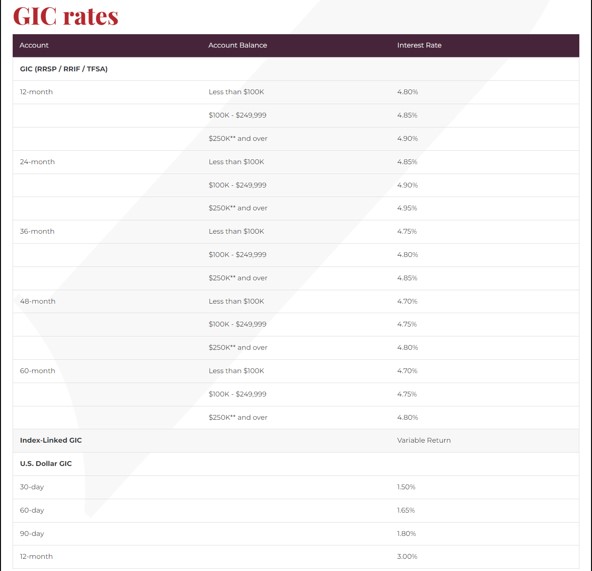

GICs

GICs are guaranteed to secure your principal while offering some of the best interest rates online. You can choose a term between one and five years, allowing you to customise your savings schedule.

Whether you want to save for a new car or put money aside to help pay your mortgage, SCU offers GICs perfect for getting started on your goals. You can hold your GICs in an RRSP, RRIF, TFSA, RESP, or RDSP.

Online Investing

If you want to build your own investment portfolio and execute trades yourself, Qtrade Direct Investing is your best option. It gives you account options, investment choices, and research tools needed to build a custom portfolio.

You can choose the best investments and make trades from your mobile device or desktop:

- $8.75 stock trades for all investors

- $6.95 stock trades for active traders

- 100 commission-free ETFs

Guided Investing

Qtrade Guided Portfolios combines intelligent software with professional money managers to give you the best mix of investments to reach your financial goals.

To start investing, you only need to answer a few questions about your financial objectives and risk tolerance.

Other SCU Investment Accounts

- TFSA: Fixed-rate GICs, U.S. Dollar GICs, and index-linked GICs

- RRSP: RRSP variable savings, RRSP GICs, and mutual funds

- RRIF: RRIF variable savings and RRIF GICs

- RESP: Variable savings and GICs

Steinbach Credit Union Borrowing and Credit Cards

SCU offers Canadians lines of credit, personal loans, insurance, and mortgages. In association with Collabria, Steinbach Credit Union rolled out the following cards:

Credit Cards

- SCU Collabria Cashback Mastercard

- SCU Collabria World Mastercard

- SCU Collabria Centra Visa Gold Card

- SCU Collabria Classic Mastercard

- SCU Collabria U.S. Dollar Mastercard

RELATED: The Best Credit Cards in Canada

Mortgages

With Steinbach Credit Union online, there are various mortgages to choose from. You can go for whatever suits you best.

- Home Mortgages

- Condominium Mortgages

- Renovation Mortgages

- Self-Build Mortgages

- Contract-Build Mortgages

- Rental Property Mortgages

- Vacation Property Mortgages

- New to Canada Mortgages

For more details about the peculiarities of each mortgage, you can visit the Steinbach Credit Union mortgage pag

Loans and Lines of Credit

Steinbach Credit Union online also offer borrowing services like loans and lines of credit that affords you more flexibility when borrowing.

With their loans, you get access to competitive interest rates, repayment plans that are super flexible, and the absence of prepayment penalties.

With their line of credit, you work with a credit limit that is approved beforehand and competitive interest rates. What’s more? Interest is only paid on used funds.

Loan

- Personal loans

- Registered investment loan

- e-Loan

Lines of Credit

- Personal line of credit

- Personal equity link line

- StudentFLEX line of credit

- Overdraft link line

Other Steinbach Credit Union Online Services

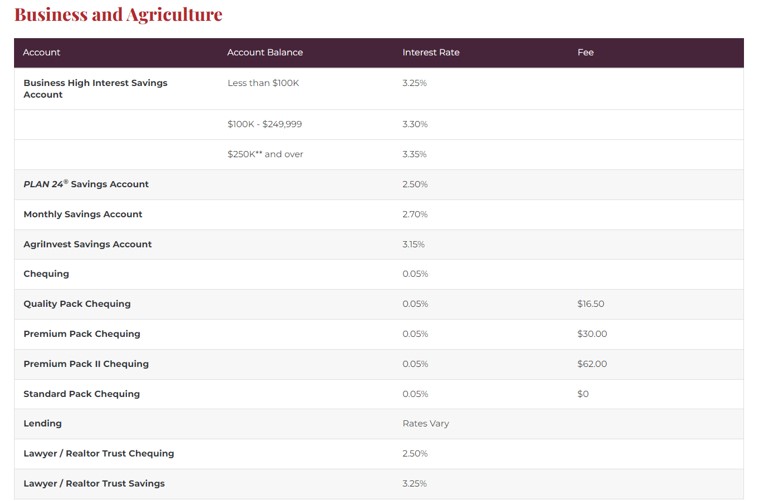

Business and Agriculture

SCU offers special savings and chequing accounts for businesses and agriculture to help you reach your business savings goals faster. They can even provide funds to help start or grow your business or expand your operation.

With SCU business and agriculture, you can get competitive products and expert advice to secure the future of your business and take your business to the next level.

However, these come at special rates. Check out the rates below:

Wealth Management

In partnership with Credential, SCU aims to use its expertise and wealth of experience to give you wealth management suggestions and recommendations that can be useful. Their financial advisors are generally regarded as qualified and experienced professionals.

After getting to know your situation, they will analyse it and create a suitable financial plan. Next up is the implementation of the plan, in which constant reevaluations will promptly follow to ensure things are going smoothly.

These are the wealth management services that Steinbach Credit Union provide:

- Savings and investment strategies

- Comprehensive retirement planning

- Portfolio monitoring and re-balancing

- Tax-efficient investing

- Family wealth management

- Personal and business insurance planning

- Business succession consultation

Customer Automated Funds Transfer

This service lets you pay staff, send money to other financial institutions’ accounts, and facilitates sending money to customers.

In addition to it being safe and cost-effective, all transactions can be traced and audited. What’s more? It can work with most accounting software.

Business Owner Protection

For those who want to know the safety measures Steinbach Credit Union has in place, this is what Business Owner and Payment Protection are there for (especially if you are a business owner).

With payment protection insurance, you can safeguard your business and those you love in an unfavourable event. Equipment, inventory, real estate, and cash reserves can all be secured.

Undoubtedly, your employees’ salaries can be safe, and they can get coverage in case of injury, death, sickness, or critical illness. In addition, it helps to boost credit ratings.

How To Contact Steinbach Credit Union

You can perform your banking transactions in person at any SCU branch, online or via telephone.

Contact SCU Monday to Friday (8 am to 8 pm) and Saturday (8 am to 4 pm) for general enquiries. Also, you can download their mobile app on your iPhone or Android devices.

Steinbach Branch Contact:

- 333 Main Street, Steinbach, MB R5G 1B1

- Phone: 204-326-3495

- Toll-free: 1-800-728-6440 (for all branches)

Lagimodiere Branch:

- 1575 Lagimodiere Boulevard, Winnipeg, MB R3W 0B9

- Phone: 204-661-1575

Linden Ridge Branch:

- 2100 McGillivray Blvd., Winnipeg, MB R3Y 1X2

- Phone: 204-222-2100

Final Thoughts on Steinbach Credit Union Review

Steinbach Credit Union is a trusted financial institution that has served the communities of Steinbach and surrounding areas for over 80 years.

With over 100,000 members and assets of over $7 billion, it is one of the largest credit unions in Manitoba, Canada.

SCU offers various personal and business banking products and services, including investment and insurance services.

Although it has only three physical locations, it provides excellent customer service and competitive rates. You can choose one that best suits your needs and budget from the different chequing accounts available.

Steinbach Credit Union is an excellent option for a reliable and community-oriented financial institution.

FAQs on Steinbach Credit Union Review

What Will it Take for Steinbach Credit Union to Lend Me Money Online?

Before applying for a loan, you should get an idea of what your credit score is. A good credit score will help you secure the best interest rate possible, saving you money over the life of the loan.

Also, look at how much money you have in savings, how long you’ve been at your current job, and whether or not you have any other loans or debts outstanding.

RELATED: What is a Good Credit Score?

How Do I Become a Member of Steinbach Credit Union?

It’s pretty easy to become part of them. On their website, you can click the “Join SCU” option on their Become a Member page to start the process. You can also visit any of their branches and make your intentions known.

Can I Use Steinbach Credit Union From My Phone?

Yes. With Steinbach Credit Union’s Internet and telephone banking services, you can check your account balances, make payments and transfers, manage your investments, pay bills, and more—all from the comfort of your own home or office.

You can also access your SCU accounts with the SCU mobile app available for iOS and Android devices.

What is a Guaranteed Investment Certificate?

A guaranteed investment certificate (GIC) is an interest-bearing financial instrument sold by Canadian banks and trust companies.

GICs are insured and government-backed, so the risk of loss is low compared to other investments, and they come with a fixed rate of return, which means that the value of your investment will not change over time.