Most financial experts in Canada have confirmed that it is best to be passive investors and allocate funds to Exchange-Traded Funds (ETFs). Most Canadians don’t have the time or expertise to pick individual stocks, so investing in a financial instrument can diversify your risk is best.

If you want to diversify your portfolio and maximize your returns, the Vanguard S&P 500 ETF (VFV) might be the right solution for you.

Exchange-traded funds, like VFV ETF, make it easier to diversify your portfolio holdings while saving on management fees. ETFs hold a basket of stocks and give you exposure to many sectors and industries required for diversification.

This VFV review discusses the Vanguard S&P 500 ETF, its pros and cons, holdings, performance, and how it compares to other ETFs in Canada.

What is VFV ETF?

The Vanguard S&P 500 Index ETF, also called VFV ETF, is a US-equity ETF from Vanguard Canada designed to replicate the performance of the Vanguard S&P 500 ETF and track the performance of large-capitalization U.S. stocks.

The VFV ETF was launched on November 2, 2012, and is traded on the Toronto Stock Exchange under the “VFV.TO” ticker symbol. It is currently trading at around $92.14.

This ETF allows Canadian investors to gain exposure to large U.S. stocks, which are complex and inconvenient to purchase single-handedly. However, VFV ETF is an all-equity ETF with no fixed-income securities. It is riskier than other balanced ETFs and should be held in a diversified portfolio.

Key Facts about VFV ETF (As of January 11, 2024)

- Inception date: November 2, 2012

- Currency traded: CAD

- Assets under management: $10.18 billion

- Management fees: 0.08%

- MER: 0.09%

- 12-month trailing yield: 1.20%

- Distribution yield: 1.52%

- Distribution frequency: Quarterly

- Exchange: Toronto Stock Exchange

- Ticker symbol: VFV.TO

- Eligible accounts: RRSP, TFSA, TFSA, DPSP, RRIF, RDSP

Benefits and Drawbacks of VFT ETF

Like other ETFs in Canada, VFV ETFs have their benefits and drawbacks. You should carefully consider the pros and cons of VFV before deciding whether or not VFV is suitable for you.

Pros

- Passively managed stock portfolio

- Low management fees

- Low-cost ETF with an MER of just 0.08%.

- Broad exposure to top American companies

- It uses efficient, cost-effective index management techniques.

- It invests in over 500 U.S. stocks with a median market capitalization value of over $232 billion.

Cons

- 100% Equity could be volatile

- Riskier ETF portfolio

- No international exposure. The fund invests 100% in the USA.

VFV ETF Returns/Performance

Compared to other ETFs in Canada, VFV ETF is slightly ahead in terms of long-term performance. VFV ETF tracks the benchmark S&P 500 performance very closely, and there is very little variance.

However, note that historical performance does not guarantee that VFV will perform well in the future.

Source: www.vanguard.ca

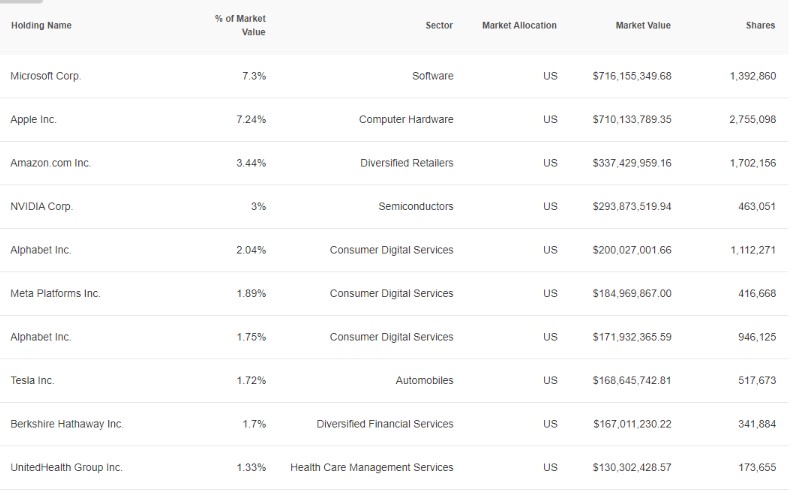

VFV Holdings

Unlike Vanguard’s VGRO and iShares XGRO, which have 80% equity and 20% fixed-income assets, VFV is a pure stock-based fund.

It has a diversified portfolio, holding about 505 stocks (as of October 26, 2022). The portfolio asset mix is reconstituted and rebalanced quarterly at the discretion of the sub-advisor.

VFVETF offers a nicely diversified range of companies, from banking and finance to big tech companies, to consumer goods. About 82% of the VFV fund’s allocation is geared towards large-capitalization stocks, followed by 12% in medium-capitalization stocks.

The balance of about 6% is in medium to large and medium- to small-capitalization U.S. stocks. The top 10 holdings include familiar names like Apple (technology), Tesla (automobile), Alphabet (media), etc.

Source: www.vanguard.ca

VFV Sector Weighting

One of the greatest benefits you get from VFV is the diversification of the stocks in different sectors of the U.S. economy. This diversification helps to reduce your risk level by spreading investments across various industries.

The S&P 500 index ETF diversifies into a wide range of industries, from technology to financial service firms, consumer products, and healthcare providers.

The great thing about the U.S. stock market is the diversity of the companies. As you can see from the sector weightings below, you get a nice weighted mix of many different sectors.

Contrast this with the Canadian stock market, which is heavily weighted in only three main sectors: Energy, Real Estate, and Mining, and it’s a large reason why I think the U.S. market is much more dynamic.

Sector | Fund |

Information Technology | 29.09% |

Financials | 12.9% |

Health Care | 12.7% |

Consumer Discretionary | 10.73% |

Communication Services | 8.61% |

Industrials | 8.29% |

Consumer Staples | 6.3% |

Energy | 4.1% |

Materials | 2.44% |

Real Estate | 2.43% |

Utilities | 2.3% |

Total | 100.0% |

VFV Fees

VFV ETF offers the lowest management fees for a broad, diversified ETF in Canada. Its management fees and MER are:

- Management fees: 0.08%

- Management Expense Ratio (MER): 0.09%

Source: www.vanguard.ca

VFV attracts passive investors with its low fees, making it a desirable investment option

Is VFV a Good Investment?

Canadians seeking to diversify their portfolio outside Canada will find VFV ETF a good investment. VFV is a good way for Canadian investors to diversify their holdings and gain exposure to popular blue-chip companies. VFV provides broad exposure to popular US stocks with a medium risk level.

Its 0.08% management fee makes it a desirable investment. You can easily invest in US stocks using Canadian dollars rather than going for ETFs listed on a US exchange and traded in US dollars.

However, VFV can be volatile and decline if the market doesn’t perform well. So, if you are looking for capital growth and income with a lower risk level, VFV ETF is not ideal for you.

VFV ETF provides exposure to large US stocks ranging from IT, healthcare, consumer discretionary, and financial sectors. This amazing ETF entails a medium level of risk and is suitable for Canadian investors who want long-term capital growth and don’t mind stock market volatility.

How To Buy VFV ETF in Canada

VFV ETF isn’t for everyone. However, suppose

- You are looking for a low-fee passive investing solution that tracks the U.S large-capitalization stock market,

- You fully understand the risks involved with purchasing ETFs with 100% equity fund and are using this ETF in combination with your overall investment strategy,

- Also, understand that if you’re using this ETF in combination with other fixed-income funds, you must rebalance your asset mix at set time intervals.

In that case, you should consider buying VFV ETF.

You can buy VFV ETF through Wealthsimple Trade and Questrade. They are both commission-free brokerage firms in Canada. You can also use any self-directed investment platform available in Canada to buy VFV.

How To Buy VFV Using Wealthsimple Trade

Wealthsimple Trade is a Canadian brokerage firm that allows you to trade many stocks and ETFs without paying any commission. It offers a cost-effective way to build your diversified portfolio.

Wealthsimple Trade has no account minimums and offers a straightforward trading process. You must have a Trade account to buy VFV ETF through Wealthsimple Trade. Click here to open an account and get a massive welcome bonus.

If you already have an account, search for VFV using the ticker symbol “VFV” and start trading. Then click “BUY” and follow the prompts to complete your trade order.

How To Buy VFV using Questrade

Questrade is also a Canadian discount brokerage account that offers novice and experienced Canadian investors a competitive and reliable platform to trade ETFs, bonds, stocks, etc.

Questrade doesn’t charge any commission for buying VFV, but it sets a fee of $4.95 for every VFV you sell. Like Wealthsimple Trade, you need an account before trading on Questrade.

Click here to open your account on Questrade and receive a huge sign-up bonus. Once you have opened and funded your account, you can start trading VFV by searching for the ticker symbol “VFV”.

VFV vs VSP

VSP is the Canadian hedged version of the Vanguard S&P 500 index ETF (VFV). The VSP also tracks the same U.S. stocks but hedges the currency exposure to the Canadian dollar.

Suppose the US dollar weakens or strengthens against the Canadian dollar. In that case, VSP protects your portfolio and helps to eliminate any foreign exchange rate effects.

VSP requires a small fee for hedging your position and protecting your portfolio. It has a 0.09% MER.

Check out this VFV vs VSP ETF Review

VFV vs VOO

While VFV is a Canadian Vanguard S&P 500 index ETF traded in Canadian dollars on the Toronto Stock Exchange, VOO ETF is listed on the New York Stock Exchange and traded in US dollars.

VOO ETF also tracks S&P 500, but Vanguard United States offers it. As a Canadian investor, if you choose to invest in VOO using Canadian dollars, you have to source for US dollars or carry out currency conversion on your investment platform.

You will be paying FX fees of up to 2%, and these fees might add up and eat into your portfolio returns.

In contrast, when you purchase VFV ETF, you won’t pay any FX fees because it is listed on the Toronto Stock Exchange, and you can trade them in Canadian dollars.

VFV vs VEQT

The Vanguard All-Equity ETF Portfolio (VEQT) is an ETF from Vanguard Canada that invests all its funds in equity. Unlike VFV, VEQT is diversified with investments in several companies in different countries across the world.

It is globally diversified into the US, Canada, other developed countries, and emerging markets worldwide. While VFV allocated 100% of your funds to US stocks, VEQT gives only about 40% to US stocks and the rest to other countries.

However, VFV ETF is much cheaper in terms of fees than VEQT. VFV has an MER of 0.09% compared to VEQT’s 0.24%.

Check out this VEQT ETF Review

Final Thoughts on VFV Review

Suppose you want to invest in the US large capitalization equity securities, seeking long-term capital growth, and can stomach the stock market’s volatility. In that case, you should consider the VFV ETF.

Everyone has their risk tolerance and investment needs. Growth and aggressive portfolios are only for some. You should invest in line with your risk tolerance level.

If you can stomach the risk level of VFV, you should go for it. If you cannot, you can choose alternatives with lower risks, like VEQT.

FAQs on VFV ETF Review

Is VFV good for Canadians?

VFV ETF is an excellent option for Canadian investors to diversify their portfolios and gain exposure to prominent companies in the United States.

Is VOO better than VFV?

While VFV trades in Canadian Dollars, VOO trades in US Dollars. So, Canadian investors will save more on currency conversion fees when they invest in VFV instead of VOO.

Is VFV hedged?

VFV is not hedged. However, if you are interested in purchasing the currency-hedged Vanguard S&P 500 Index ETF, you should go for the VSP, which is CAD-hedged.