If you’re looking for simple, low-cost investments that align with your values and beliefs, Wealthsimple Halal might be your perfect match.

Wealthsimple Halal is an investment portfolio fully compliant with Islamic finance principles, managed by a team of professionals who select halal investment options in accordance with Shariah law, designed for individuals seeking investments aligned with their values and beliefs.

In this Wealthsimple Halal Portfolio review, we will provide an overview of Wealthsimple’s Halal Portfolio, including its features, investment strategies, fees, and the pros and cons of investing in halal portfolios to help you determine if the portfolio is a good investment choice for you.

Wealthsimple Halal is an Islamic-based investment portfolio consisting of 50 stocks in an ETF. The portfolio complies with Shariah principles based on the Quran, the holy book of Muslims. Wealthsimple ensures that Islamic scholars assess all investments in the portfolio. As a result, the portfolio does not invest in companies that drive more than 5% profit.

Overview of Wealthsimple Halal Investing

Founded in 2014, Wealthsimple is one of Canada’s most popular robo-advisors. The company is known for its top-notch financial solutions and investments. Wealthsimple has customized products for different individuals, from cash, investment and trade.

In 2017, Wealthsimple launched the Halal investing portfolio, the first of its kind in Canada. The Wealthsimple Halal is an Islamic-based investment portfolio consisting of 50 stocks in an ETF. The portfolio complies with Shariah principles based on the Quran, the holy book of Muslims.

Islamic Law prohibits Muslims from investing and making profits from loans by collecting interest, so assets like bonds and GICs are not included in the Halal portfolio.

Hence, Wealthsimple ensures that Islamic scholars assess all investments in the portfolio. The portfolio does not invest in companies that drive more than 5% profit and doesn’t include, promote, participate, or invest in activities or businesses involving:

- Tobacco

- Weapons

- Gambling

- Alcohol

- Adult entertainment

- Pork-related products

- Insurance

- High interest on loans

All these are forbidden (haram) in Islam, making the worship of a Muslim unholy. The Halal portfolio is authorized and regulated by Rating Intelligence Partners’ team of Islamic researchers.

So the major goal of Halal investing is to help Muslim investors become wealthy without compromising the tenets of Islam.

The Halal portfolio is unlike other investment portfolios in Canada. It is designed to comply with Islamic Laws while maximizing your returns, reducing your investment and trading fees, and eliminating the stress of portfolio rebalancing.

RELATED: Best Robo-advisors in Canada

Wealthsimple Halal Investment Portfolio Strategy

To achieve its goal, this portfolio invests your money in 50 stocks through Islamic-based exchange-traded funds (ETFs).

So through its collaboration with Shariah scholars from the MSCI Shariah advisors’ committee, Wealthsimple establishes an Islamic Index Methodology that determines the combination of funds perfect for the Halal portfolio.

As a result, Wealthsimple eliminates companies that earn more than 5% profit from tobacco, alcohol, gambling, weapons, pornography, and loan interest, among other forbidden businesses in Islam.

Pros of Wealthsimple Halal

- Competitive fees.

- Free educational resources.

- Passive investment methodology.

- Free customized guidance from finance experts.

- No hidden/additional fees.

- Automatic portfolio rebalancing.

Cons of Wealthsimple Halal

- All-equity portfolio with no bonds (equals to aggressive risk).

- Limited diversification (50 stock holdings, some stockbrokers hold more than 100 stocks).

Who is Eligible for the Wealthsimple Halal Investment Portfolio?

Wealthsimple’s Halal portfolio is tailored towards Muslims who want to comply with the tenets of Islam. However, Halal investing is not only for Muslims. Anyone who wants to apply Islamic or socially responsible principles can invest in this portfolio.

The portfolio is available to Canadian and US investors with long-term investment objectives with much or small capital. It is perfect for investors with mid-high risk tolerance and comfortable with long-term portfolios.

But you must have a high-interest savings account or build an emergency fund before investing in this portfolio.

Wealthsimple Halal Investment Accounts

It is important to check if your investments have a range of account options to help you determine if the portfolio consists of your desired investing accounts.

With Wealthsimple’s Halal investing, you have several accounts to invest in, such as:

- TFSA

- RRSP

- RRIF

- RESP

- LIRA

- Non-registered accounts

Observant Muslims can use the Halal portfolio to invest in these accounts.

Wealthsimple Weighting & Holdings

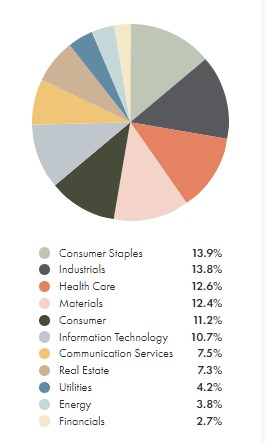

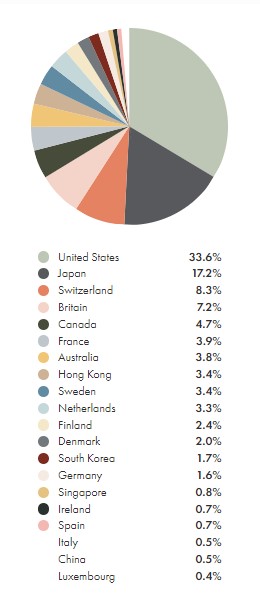

Here are the holdings and allocations of Wealthsimple Halal across different sectors:

Industry Weight

Geographic Weight

Top Holdings

Wealthsimple Halal Investment Portfolio Risk Levels

Before investing in any portfolio, knowing its risk levels as it compares with your risk tolerance is important.

Halal investment companies are not weighted by market capitalization but by risk. They are selected based on their ability to survive on low market volatility. Below are Wealthsimple’s Halal investing risk levels:

Conservative: For investors seeking stability and modest returns.

- Wealthsimple Shariah World Equity Index ETF (WSHR) = 40%

- Gold = 15%

- Non-interest bearing cash = 45%

Balanced: For investors with medium to high-risk tolerance levels.

- Wealthsimple Shariah World Equity Index ETF (WSHR) = 70%

- Gold = 20%

- Non-interest bearing cash = 10%

High Growth: For investors with high-risk tolerance levels.

- Wealthsimple Shariah World Equity Index ETF (WSHR) = 90%

- Gold = 10%

- Non-interest bearing cash = 0%

Wealthsimple Halal Portfolio Fees

Wealthsimple’s Halal portfolio fees are the same as the regular and socially responsible portfolio. It charges a 0.5% management fee for an initial $100,000 deposit and 0.4% for subsequent deposits.

Notably, this is a competitive fee compared to the fees of other firms. This means that you will invest more with fewer fees on this portfolio.

Is Wealthsimple Halal Portfolio Safe?

Yes. Wealthsimple Halal Portfolio is absolutely safe. Wealthsimple holds your funds with the Canadian ShareOwner Investments Inc., regulated by the IIROC and is also a Canadian Investor Protection Fund (CIPF) member.

Your account is protected against insolvency or bankruptcy for up to $1 million. Also, the company uses bank-level encryption to protect your information against hackers.

They use state-of-the-art data encryption when handling your financial information and offer a 2FA authentication for your protection.

They are trusted by over 1 million Canadians who have invested over $10 billion with Wealthsimple companies.

How to Open a Wealthsimple Account

Opening a Wealthsimple Halal takes just 5 minutes. All you need to open the account is to follow these simple steps:

- Visit the Wealthsimple sign-up page

- Enter your email

- Provide password

- Enter your country (Canada or the UK)

- Confirm your email

- Fill out a questionnaire about your investment objective and risk tolerance

- Fund your account

- Start investing

Also, you can open a Wealthsimple account through the Wealthsimple app accessible on Google Playstore and Apple Store.

However, you can access the Wealthsimple Shariah World Equity Index ETF (WSHR) on other online brokerages.

Wealthsimple Halal vs Wealthsimple Socially Responsible Investing: Which is Better?

Wealthsimple’s Halal and Socially Responsible Investing (SRI) offer a way for investors to align their investments with their values, but they differ significantly.

The Wealthsimple Halal portfolio is designed for Muslim investors who want to invest in a way that complies with Shariah law.

The portfolio excludes companies involved in activities like alcohol, tobacco, gambling, and those dealing with weapons manufacturing or adult entertainment. It’s managed by a team of investment professionals who carefully select halal investment options.

On the other hand, Wealthsimple SRI is designed for investors who want to invest in companies with a positive social and environmental impact.

The portfolio invests in companies that meet certain ESG (Environmental, Social, and Governance) criteria, such as those with strong labour practices, low carbon emissions, or a commitment to diversity and inclusion.

Both investment options charge the same management fee. However, underlying MERs paid to ETF providers vary for both options.

Final Thoughts on Wealthsimple Halal Portfolio Review

Wealthsimple Halal provides an excellent investment opportunity for individuals looking to align their values and beliefs with their investment portfolios.

With a fully compliant Islamic-based investment portfolio, Wealthsimple Halal is designed to ensure that Muslims can invest in financial products without violating Islamic laws.

The portfolio is managed by investment professionals, and Wealthsimple collaborates with Shariah scholars to determine the combination of funds perfect for the Halal portfolio.

While the portfolio has benefits and downsides, it is a good investment choice for investors looking for low-cost investments that match their values. It is available to Canadians and Americans with long-term investment objectives and a mid-high-risk tolerance level.

Finally, if you have any questions or concerns about this Halal Investing Canada review, let me know in the comment section.

There is a pretty key typo in this article. The word for forbidden is not Halal – rather haram. Halal is the opposite, meaning permissable.